- And the lessons it provides pertaining to today's economy.

Today we commemorate an important day in history, namely "Black Thursday," which occurred on October 24, 1929, just 83 years ago.

Today we commemorate an important day in history, namely "Black Thursday," which occurred on October 24, 1929, just 83 years ago.

Today, the world is still reeling from "The Great Recession," which put our global economy into a tailspin thereby affecting not just the United States, but all of the countries of the world. Blame can be placed on a compendium of variables, such as the credit boom, bad banking policies, bursting the real estate bubble, etc. This led to a global tsunami of unemployment, and a significant drop in international trade. There were few people who were unaffected by the recession. Business as we knew it, was gone, and remains so. As devastating as it was though, it paled in comparison to the grand daddy of economic meltdowns, "The Great Depression."

On October 24th, the stock market lost 11% of its value at the opening bell on very heavy trading. Nothing this dramatic had happened before thereby earning the nickname "Black Thursday." Wall Street bankers sought a way to stop the slide and opted to buy U.S. Steel and several other Blue Chip stocks well above their current market value, a trick used to stop the panic of 1907. Indeed, it halted the slide, at least until the following Monday ("Black Monday") when investors opted out of the market in record numbers. Despite additional attempts to prop up stock prices, the market plummeted thereby triggering a worldwide depression.

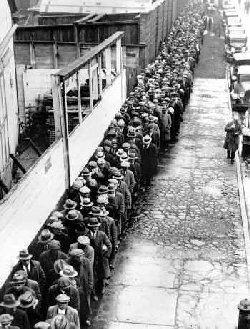

The Great Depression lasted for over ten years. Companies closed their doors, unemployment was rampant, soup lines grew, and investors committed suicide by jumping out of buildings financially ruined. Our lifestyle changed radically, from prosperous to desperate. In the average household, all members of the family were expected to cut costs and chip in to pay bills, regardless of their age. No job was considered insignificant or taken for granted. A High School diploma was a prized possession as many people had to drop out of school to earn a wage to support their family. A lot of people were lucky to earn nothing more than a Junior High School diploma (8th grade). The Great Depression sent shock waves through our very sinew, leaving nobody unaffected. You learned to improvise, adapt, and hustle in order to survive.

Because of its scope and dramatic human impact, The Great Depression made The Great Recession seem like child's play. There was little government support, certainly nothing like the entitlements known today, such as Food Stamps which weren't offered until the 1960's. Soup kitchens sprung up to feed the needy, sponsored by churches and other institutions.

Despite numerous attempts by the government to snap the country out of the depression, it was the industrialization of World War II that brought us out of it. Since then, safeguards have been installed in the stock markets to help avoid another major crash, but they are certainly not foolproof as we have seen with many slippages over the years, most recently:

| DATE | DROPPED | PERCENT |

| 2011-08-08 | -634.76 | -5.55% |

| 2011-08-10 | -519.83 | -4.62% |

| 2011-08-04 | -512.76 | -4.31% |

Others within the last 25 years:

| DATE | DROPPED | PERCENT |

| 1987-10-19 | -508.00 | -22.61% |

| 2008-10-15 | -733.08 | -7.87% |

| 2008-12-01 | -679.95 | -7.70% |

| 2008-10-09 | -678.91 | -7.33% |

| 1997-10-27 | -554.26 | -7.18% |

| 2001-09-17 | -684.81 | -7.13% |

| 2008-09-29 | -777.68 | -6.98% |

The big question though is whether it is possible to experience another depression on the scale of the 1920's. The answer obviously is, Yes, although politicians and economists will resist the use of the word as it is considered political suicide. If the country's debt rises above the Gross Domestic Product, as it obviously will, the dollar will weaken, as will stocks, thereby triggering a collapse. Another variable is the weakened European economy which affects our own. If Europe collapses, there is a good chance they will drag us down with them.

And when the money is gone, businesses will close, unemployment will rise to record levels, and our lifestyles will once again be dramatically altered. Some would argue this is just the tonic America needs to mend its economic recklessness.

The Great Depression may seem like a distant memory, particularly to young people voting in the upcoming elections for the first time, but we should all pay heed to the lessons it conveys. If you had trouble surviving the recent Great Recession, try to remember the Great Depression dwarfed it. We are by no means out of the woods yet.

Keep the Faith!

Note: All trademarks both marked and unmarked belong to their respective companies.

Tim Bryce is a writer and the Managing Director of M&JB Investment Company (M&JB) of Palm Harbor, Florida and has over 30 years of experience in the management consulting field. He can be reached at timb001@phmainstreet.com

Tim Bryce is a writer and the Managing Director of M&JB Investment Company (M&JB) of Palm Harbor, Florida and has over 30 years of experience in the management consulting field. He can be reached at timb001@phmainstreet.com

For Tim's columns, see:

timbryce.com

Like the article? TELL A FRIEND.

Copyright © 2012 by Tim Bryce. All rights reserved.

No comments:

Post a Comment