Most Americans are familiar with the vast debt our country has compiled ($14.8T as of this writing and growing steadily). We are also acutely aware of the burden of mortgages and credit card debt, particularly in this age of high unemployment. As if things weren't bad enough, a new statistic has emerged courtesy of the College Board who reports student loans are about to cross the $1T threshold as students are borrowing twice as much as just a decade ago and the outstanding debt has doubled in the last five years alone. The debt is growing so rapidly that the Federal Reserve Bank of New York recently calculated this will make Americans owe more on student loans than credit cards, which is a frightening thought (see Northern Voices Online, 10/21/2011).

Most Americans are familiar with the vast debt our country has compiled ($14.8T as of this writing and growing steadily). We are also acutely aware of the burden of mortgages and credit card debt, particularly in this age of high unemployment. As if things weren't bad enough, a new statistic has emerged courtesy of the College Board who reports student loans are about to cross the $1T threshold as students are borrowing twice as much as just a decade ago and the outstanding debt has doubled in the last five years alone. The debt is growing so rapidly that the Federal Reserve Bank of New York recently calculated this will make Americans owe more on student loans than credit cards, which is a frightening thought (see Northern Voices Online, 10/21/2011).

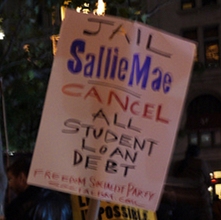

Not surprising, among the demands made by the young "Occupy Wall Street" protesters is to have their college loans expunged. Such loans are typically sponsored by the federal government and private financial institutions. To expunge them would mean the taxpayers and private financial institutions would get stuck with their bill which would obviously compound an already overbearing debt. Plain and simply, it wouldn't be fair; not fair to those who paid for their education, and not fair for taxpayers to pay a tab which others incurred.

Americans place a lot of emphasis on education but we should be mindful of the fact that attending college is not a right, but a privilege. During the Depression years prior to World War II, there was no more than 1.4M college level students attending approximately 1.7K institutions of higher education. Today, according to the Digest of Education Statistics, over 19.1M students attend 4.4K colleges, a quantum increase. Since the 1960's alone, when colleges experienced an influx of students seeking refuge from the Viet Nam war, enrollment has more than doubled. Back in the Depression, money was scarce and, as such, it was common for all of the members of a family to work, often sacrificing higher education in the process. Back then, a High School diploma was considered a prestigious achievement. Even a Junior High diploma was prized as some people could not afford to rise above this level.

Unless something radical happens to our economy, I suspect enrollment has peaked in this country and will likely begin to diminish sharply. This will inevitably lead to downsizing of faculty and administrative staff and some campus doors will be forced to close. We've already started to see this here in Florida and I suspect we're not any different than the rest of the country in this regard.

So, am I a fan of expunging college loans? Hardly, nor am I a proponent of waiving credit card debt. I can appreciate the dilemma people face in paying off such bills, but a deal is a deal. Where I come from, people who renege on their debt are called "deadbeats," and I fear we are grooming a generation of them, people who do not understand what it means to live within their means. The only benefit I see emerging from this is that people will begin to realize attending college is a privilege, not a right, and a college education will no longer be taken for granted.

Keep the Faith!

Note: All trademarks both marked and unmarked belong to their respective companies.

Tim Bryce is a writer and the Managing Director of M. Bryce & Associates (MBA) of Palm Harbor, Florida and has over 30 years of experience in the management consulting field. He can be reached at timb001@phmainstreet.com

Tim Bryce is a writer and the Managing Director of M. Bryce & Associates (MBA) of Palm Harbor, Florida and has over 30 years of experience in the management consulting field. He can be reached at timb001@phmainstreet.com

For Tim's columns, see:

http://www.phmainstreet.com/timbryce.htm

Like the article? TELL A FRIEND.

Tune into Tim's THE BRYCE IS RIGHT! podcast Mondays-Fridays, 7:30am (Eastern).

Copyright © 2011 by Tim Bryce. All rights reserved.

A college loan also gets less attention fee. Such low attention are generally provided like a secured fee. On these kinds of events when set attention levels are provided, a college student gets to an side if attention rates are expected to development of the long run.

ReplyDeleteQuickcash