This week Congress resumes talks concerning the 2012 federal budget and upping the debt ceiling as we are rapidly approaching its limit. In researching this, I learned the U.S. Treasury conducts more than 200 sales of debt (Treasury Securities) by auction every year. They are authorized by Congress to do so as long as they do not exceed the limit. Since President Obama has been in office, we have raised the ceiling four times, with the last one implemented just last year. I think most Americans understand the immensity of the federal debt, which is currently $14.3T, but I do not believe they understand the rapidity by which it is growing. The 2011 budget talks did nothing to slow down the debt which is still running unabated. The interest on the debt alone will soon reach a point where it is going to overwhelm our ability to pay it back and, as a result, will cut into important government programs, including defense, which is why this next round of budget talks are so important. We simply cannot continue to operate business as usual, not unless we are deliberately trying to undermine the country.

This week Congress resumes talks concerning the 2012 federal budget and upping the debt ceiling as we are rapidly approaching its limit. In researching this, I learned the U.S. Treasury conducts more than 200 sales of debt (Treasury Securities) by auction every year. They are authorized by Congress to do so as long as they do not exceed the limit. Since President Obama has been in office, we have raised the ceiling four times, with the last one implemented just last year. I think most Americans understand the immensity of the federal debt, which is currently $14.3T, but I do not believe they understand the rapidity by which it is growing. The 2011 budget talks did nothing to slow down the debt which is still running unabated. The interest on the debt alone will soon reach a point where it is going to overwhelm our ability to pay it back and, as a result, will cut into important government programs, including defense, which is why this next round of budget talks are so important. We simply cannot continue to operate business as usual, not unless we are deliberately trying to undermine the country.

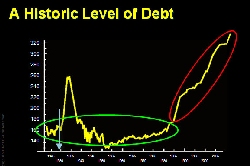

Something I don't think most Americans realize is that we have long been a debtor nation and have operated in the red since 1840 which was the last time we paid off the debt. Interestingly, I am told this did little to help the economy at the time. The debt has always risen in times of war, but we always found a way to push it back down afterwards. Regardless, the debt level is now at a new unprecedented level and close to matching or exceeding the Gross Domestic Product (GDP) which would put us in a difficult position to pay off. It is no small wonder many Americans are rightfully nervous about the future of their country.

Compounding the problem are the countries who hold the U.S. Treasury Securities, including China (who may be an important trade partner, but is still Communist), Japan (whom we have developed important ties to since World War II), the United Kingdom (an old and trusted ally), and Oil exporters (primarily OPEC countries who have called upon the United States on more than one occasion to help bail them out of security situations, often at our expense, not theirs). It is a difficult pill to swallow knowing you are beholden to foreign countries who you suspect would like to witness your demise.

The obvious answer to solving this problem is a balanced budget amendment which would force the government to live within its means, something state governments have long accepted and adopted years ago. If such a mechanism was in place already, we would not be in the financial mess we are today. The fact is our government officials can no longer be trusted to fulfill their fiduciary responsibilities as they promise their constituents and special interest groups way too much pork. There is simply no sense of discipline. Only a mechanism, such as a balanced budget amendment, would restrain them from their habitual spending.

Those who resist the notion of a balanced budget simply do not understand economics 101 or have a socialist agenda whereby they believe in expanding the size of government and making the citizens wards of the state, an expensive proposition we cannot possibly afford.

Until such time as we implement a balanced budget, we'll have to contend with debt ceilings. Frankly, I do not understand the point of having such a ceiling if our government is only going to ignore it and keep raising the bar. The way things stand, we should just abolish the debt ceiling and simply admit we cannot manage the financial affairs of this country. I would much rather abolish the debt ceiling than continue to kid ourselves that it serves any useful purpose. Long ago I learned there is little point in enacting legislation if nobody is going to adhere to it or enforce it.

One thing is for sure, is we default on our loans, we run the risk of shaking not only our economy, but the economy of the world and most likely plunging us all into a depression, the likes of which would make the Great Depression of the 1930's seem like child's play. Let's hope we get our act together before it is too late.

Keep the Faith!

Note: All trademarks both marked and unmarked belong to their respective companies.

Tim Bryce is a writer and the Managing Director of M. Bryce & Associates (MBA) of Palm Harbor, Florida and has over 30 years of experience in the management consulting field. He can be reached at timb001@phmainstreet.com

Tim Bryce is a writer and the Managing Director of M. Bryce & Associates (MBA) of Palm Harbor, Florida and has over 30 years of experience in the management consulting field. He can be reached at timb001@phmainstreet.com

For Tim's columns, see:

http://www.phmainstreet.com/timbryce.htm

Like the article? TELL A FRIEND.

Tune into Tim's THE BRYCE IS RIGHT! podcast Mondays-Fridays, 7:30am (Eastern).

Copyright © 2011 by Tim Bryce. All rights reserved.

No comments:

Post a Comment